Thesis

ASFI is a special situation equity trading at 2.8x FCF and .65x TBV with hidden off-balance sheet assets generating cash flow, strong downside protection (entire market cap in mostly in cash along with marketable securities and deferred tax assets) and a free call option on a subsidiary holding non-recourse debt. Apart from this non-recourse debt that can be ignored, the company holds no debt nor does it have any hidden liabilities. Lastly, management spent the entirety of 2012’s free cash flow on share buybacks.

We believe ASFI will begin to re-rate as management re-initiates a new share buyback program and GAAP earnings continue to grow making income much more transparent, as receivables amortize faster than collections. Our sum-of-the-parts analysis gives us an intrinsic value of $163 million or $12.59 per share which roughly equates to 40% upside. Our downside is protected by $116 million in cash, securities and deferred tax assets which covers the entire market cap.

Company Overview

ASFI is a collections company that acquires a variety of distressed consumer debt from banks, credit card companies and other collection agencies. The majority of this debt has already been previously written off by the originator (for tax incentives) and is then sold to ASFI and other distressed debt companies for 3 or 4 cents on the dollar. ASFI then tries to squeeze as much as possible out of this debt using a network of collection agencies and legal action (including wage garnishments and seizure of assets). ASFI uses the free cash flow it generates from collections to acquire new distressed consumer debt.

Company History

Like many other financial businesses, ASFI over leveraged itself right before the financial crash by purchasing a very large $300 million receivable, which doubled their total receivables (this is referred to as the “great Seneca portfolio” in their financial statements). Soon thereafter, the company was forced to make large write-downs on its portfolios. Additionally, the distressed receivable market started to move against them. Although the supply of distressed debt increased, demand grew even faster which pushed up the cost of buying new debt. Management knew this would hurt their future returns and wisely refused to overpay for receivables. The company effectively stopped purchasing new consumer debt. Their current portfolio has basically entered a stage of liquidation or run-off mode, with very little new investments into consumer debt being made. This has resulted in ASFI generating large cash flows and essentially turning into a cashbox. Currently the company holds $105 million in cash. Investors have been optimistic that management would focus on returning all of the cash to shareholders. This has turned out to be mostly true, with management initiating $16 million in buybacks over the past year – nearly the entire year’s free cash flow. Although, in the past year, management has decided to put a portion of its cash into two new business lines – personal injury claims and matrimonial claims.

Reason for Mispricing and Why this Opportunity Exists

ASFI’s most important asset does not even show up on its balance sheet. ASFI holds a number of receivables portfolios (pools) that have been fully amortized. Although these pools carry a book value of zero, they are producing very strong cash flows for ASFI. In fact, ASFI generated $40 million free cash flow in 2012, $36.4 million or 91% of this figure resulted from fully amortized pools. Although management insists that this free cash flow will remain steady for the time being, we do see the cash flow eventually decreasing slowly since the portfolio is in run-off mode. The opportunity here is obvious, hidden off-balance sheet assets hide the company’s true value to those who do not take a close look and analyze the company carefully.

ASFI’s second hidden asset is in its subsidiary that holds the Seneca pool of receivables and the non-recourse debt connected to it. Although the Seneca pool has not performed as expected and numerous write-downs have been made, this group of receivables is still generating significant cash flow but all of the proceeds are flowing directly into paying down the principal on the debt. The book value of the Seneca Portfolio ($62.8 million) is tied to the $58.8 million in non-recourse debt which would need to be paid down before finance income revenue can be generated. When the Great Seneca portfolio was acquired, it was put into a subsidiary and the debt was made non-recourse to the parent. Management has already stated that if the cash flows from the portfolio deteriorate substantially, they can just write off the portfolio and hand it over to the bank. In essence, we have a free call option on the cash flows this portfolio can generate without downside. The reason for the mispricing here is because of the fact that $58.8 in debt on the company’s balance sheet can completely be ignored.

Valuation

The company holds $106 million in cash, marketable securities and CDs on its balance sheet. Additionally, they hold $10 million in deferred tax assets. Together this represents $116 million and covers their entire market cap. This is a primary reason why ASFI has its downside completely protected.

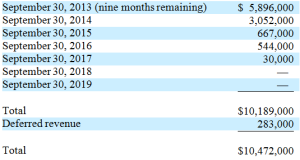

Out of $81.8 million in consumer receivables, $10.5 million is accounted for under the interest method. Asta assumes they can recover 130-140% of the book value after costs. In two and a half years, Asta should collect $12.35 million and generate $2.8 million in income. After 35% in taxes, this income stream should be worth $1.8 million.

This leaves $71.3 million in receivables which are accounted for in the cost recovery method, $62.8 million of which is tied to the Seneca portfolio. The cost recovery method is used on collections of accounts where the cash flows cannot be reasonably predicted. Under this method, no finance income is recognized until the cost of the portfolio has been fully amortized. As I mentioned above, this group of receivables is generating significant cash flow but all of the proceeds are flowing into paying off the non-recourse debt. Fortunately, the Seneca portfolio has been performing better than expected in recent results. For our purposes, we will conservatively value this segment at zero but recognize it has unquantifiable upside value.

The most important asset they have is not even on their balance sheet. These receivables are still producing very consistent cash flow but have been fully amortized and carry a book value of zero. The company can keep producing cash flow from these assets because of legal judgments that allow for wage garnishments and seizure of assets.

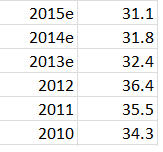

I calculated the 2013 run-rate total by extrapolating the $8.1 million that was earned in the first quarter. This is a reasonable number to use as the quarter average last year was $9.1 million. The biggest issue is how long these cash flows will remain constant, although management has insisted that there is no reason to expect a change in cash flows. We can reasonably predict that the company will earn $32.4 million in 2013, $31.8 million in 2014 and $31.1 million in 2015. Any further years of cash flow will only serve as a buffer to our margin of safety. Three more years of this cash flow gives us roughly $95.3 million in NPV. Lastly we will need to factor in G&A expenses against this cash flow, if it remains steady, $23 million per year. Taking $95.3 million, subtracting $69 million for three years which gives us $26.3 million or a net of $17 million after taxes.

Although we would have preferred management to completely focus on buying back shares and returning cash to shareholders, the company entered two new businesses in 2012 to employ their cash.

In 2012 ASFI formed a subsidiary, ASFI Pegasus Holdings and entered a joint venture with Pegasus Legal Holdings. The company works with its partner in purchasing personal injury claims from claimants who expect a legal settlement in the future. Their subsidiary calculates the expected settlement and advances an interest loan to the claimant in anticipation of their settlement. Currently the company has a $23 million net invested balance in this venture. The company earned $1.2 million in the 1st quarter of 2013 for an annualized rate of 20.8%. Based on its limited history of business, we cannot pinpoint the value of this line of business beyond its book value of $23 million. Additionally, the company has $5.4 million in “other assets” which include primarily its ownership in a matrimonial claims business with Balance Point Divorce Funding. Although we want to give management the benefit of the doubt, we are unable to ascertain the value of this line until we see steady cash flows. Evaluating the partnership arrangement, the company does have priority in claims which includes a return of their investment and a 15% preferred return. To be conservative, we will value the assets at book of $5.4 million and not calculate in any earnings power.

From our sum of the parts analysis, we believe the current value of the business should be $163 million or $12.59 a share. This is a calculated by taking the $116mil in cash (plus marketable securities and deferred tax assets) and adding 1.8mil (interest portion), 17 mil (zero basis revenue), $28.4 million (book value of personal injury and matrimonial claims businesses). This total gives zero value to the $71.3 million in account receivables under cost accounting (which includes the majority of the Seneca portfolio) which will likely bring future upside. Additionally, we conservatively projected cash flows from the zero basis receivables for three years, but cash flow is likely to continue beyond our calculated period. Our sum-of-the-parts analysis gives us an upside of roughly 40% with no downside. Additionally, it is not reasonable to expect the company to trade at 1 times its tangible book value of $13.04 which would provide an upside of approximately 45%. Our downside is completely protected by the $116 million in cash (plus marketable securities and deferred tax assets) which represents the entire current market cap.

Catalysts

Management believes the shares are undervalued and they have committed to share buybacks. In 2012, Asta spent $16.1 million buying back its shares. This is an outstanding figure, as it represents nearly their entire operating cash flow for the year. They have continued these purchases into 2013, buying $1.4 million in shares in the first quarter. Their 2012 repurchases represented 10% of their market cap. I believe share buybacks is the best way for revaluation and will serve as strong catalyst going forward.

Additionally, as receivables are being amortized faster than collections, GAAP earnings will continue to grow serving to make the company’s financials much more transparent. Outside observers will take note of the stock’s increased income generation although cash collections will remain the same.

Management & Risks

Because the company is sitting on a very large pile of cash, and has put some of that cash to work in two new businesses, we must factor in the odds that management will waste further cash on bad acquisitions or unnecessary business expansion. Additionally, although management has followed through and spent most of last year’s free cash flows on buybacks, there currently is not a buyback program in effect. On the last earnings call, Mr. Stern insisted that he was currently reviewing the details of a new repurchase agreement with the board. There is a substantial risk that management doesn’t follow through with a new repurchase agreement. However we believe management has been very mindful of shareholders. This is evident when management stopped buying receivables when they saw the distressed debt market becoming frothy. Additionally, management has very deep skin in the game, with 34% of shares belonging to insiders. Heavy insider ownership is always a good sign and it is great to see that management’s interests are aligned with shareholders.